Euler's on Instadapp

Most advanced lending protocol meets Instadapps proven strategies.

At this point, you might be thinking, “yet another protocol,” but hold that thought. Euler is different, plus we proactively integrate protocols that have a big vision for decentralization and put users and security before all.

Euler is a unique protocol built on the foundations of popular lending protocols like Compound and Aave but allows users to create their own markets for any ERC20 token. Offering a wide array of assets to lend and borrow with some of the highest collateral factors! Low-fee liquidations for some of the most liquid assets like ETH, wBTC, and USDC.

Here are some innovative concepts Euler pioneered, when combined with Instadapp’s powerful dashboard, will maximize your assets:

Permissionless Listing

Euler allows its users to decide which assets are listed. Any asset that has a WETH pair on Uniswap v3 can be added.

Whenever a new token is added on Uniswap with a WETH pair, it's automatically listed on Euler under the “unlisted” category. Once activated to the "isolated" category, users can utilize it on Instadapp.

Note: Isolated tokens will be supported very soon on Instadapp.

Asset Tiers

Euler separates their assets into tiers. You can borrow and lend a larger variety of assets with some limitations. The purpose of this is to protect users from the risk of price manipulation.

Collateral Tier: These assets can be lent, borrowed against, and combined with different asset pairs similar to assets on other lending protocols.

Cross-Tier: Assets can be used for ordinary lending and borrowing, including cross-borrowing (i.e., multiple borrowed assets per sub-account). Not available as collateral.

Isolation Tier: These assets, similar to Cross-Tier, do not have a collateral factor and cannot be borrowed against; but these assets can be borrowed in isolation. (i.e., one borrowed asset per sub-account

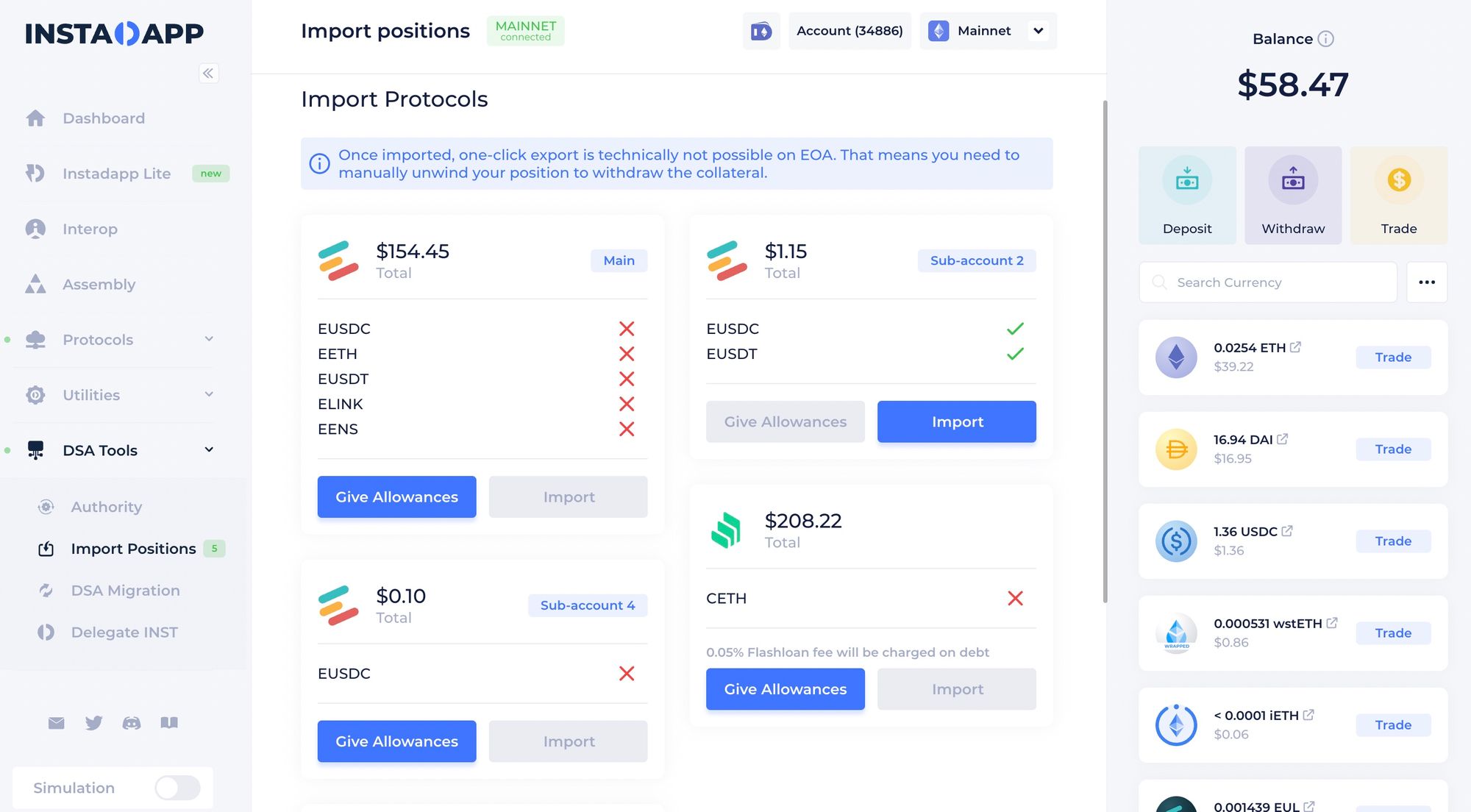

Sub-accounts

In order to support a variety of pairs, Euler uses 'sub-accounts,’ enabling users to create up to 256 sub-accounts per DSA!

These are helpful, so you won't have to approve a token multiple times for each new isolation-tier loan you want to take out.

You only need to approve Euler's access to a token once and can then deposit it into any sub-account. Sub-accounts enable a lot of unique strategies and ways to create positions.

Manage your funds or debts between sub-accounts by easily moving or migrating debt or assets using the Debt & Collateral Transfer.

Reactive Interest Rates

Euler amplifies the rate of change of the interest rates when utilization is above or below a target level to maximize capital efficiency.

Based on Euler’s whitepaper, this gives rise to reactive interest rates that adapt to market conditions for the underlying asset in real-time without the need for ongoing governance intervention.

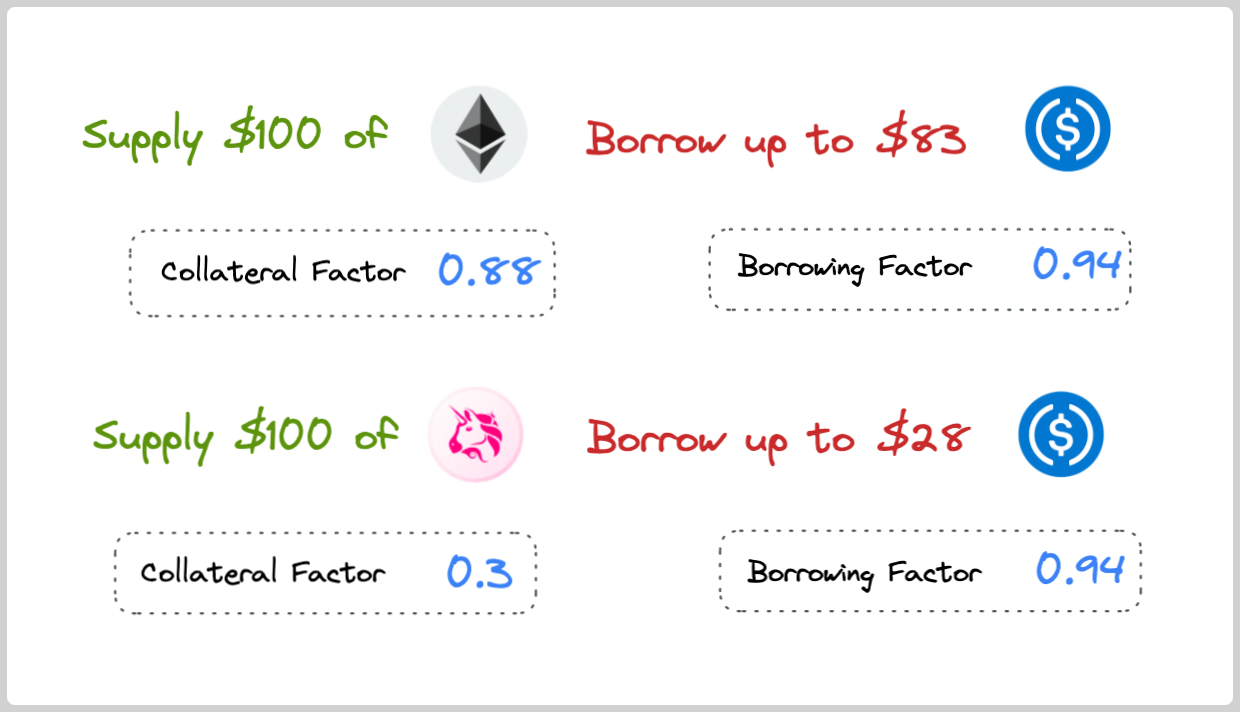

Borrowing Factor

Unlike other lending protocols, Euler considers a “Borrowing Factor,” too. They take into account the risk of borrowing assets separately from their value as collateral. This enables the protocol to offer one-sided borrowing markets on riskier assets.

This concept is part of Euler’s Risk-Adjusted Borrowing approach. The combination of the collateral factor and the borrowing factor generates how much can be borrowed.

Using Euler on Instadapp

You can create a brand new Euler position on Instadapp, or you can import your position from Euler to access Instadapp’s smart strategies like 1-click leverage, collateral swap, debt swap, debt & collateral transfer, and more. Currently, Euler is live on Mainnet.

Learn more about Instadapp by following us on Twitter for regular updates and launches, get to know us closely, and ask us those hard questions (or just say hi) up front on Discord. Nonetheless, if you need to contact us, feel free to email us.