Instadapp: A Year in Review

As 2023 draws to a close, we reflect on Instadapp's remarkable journey and innovations in the decentralized finance (DeFi) landscape. Throughout this prolonged bear market. the Instadapp team never stopped innovating! Lets review what we accomplished in 2023.

Instadapp Pro: Growth and Integrations

Instadapp Pro, our premier offering, experienced an unprecedented year of expansion. Integrating over six new protocols on Mainnet this year, including new lending protocols: crvUSD, Morpho and Spark.fi. We also integrated Savings DAI which this year became a defacto DeFi savings rate,

We deployed Instadapp Pro on Base chain with support for Compound V3 and Aave v3 support. This year we saw the Total Value Locked (TVL) maintained a steady ~$2 billion throughout the year, underscoring our resilience in the DeFi sector and the strong trust we've built with our users.

Alongside these protocol integrations, we expanded our refinancing options to include the latest protocols like Spark.Fi and Morpho as well as facilitating migrations and upgrades from AAVE v2 to AAVE v3. Instadapp was an early mover with Morpho, and we saw 50% of the Morpho v2 TVL come from Instadapp users. Instadapp Pro works directly with Avocado, providing users the ability to interact with both DeFi Smart Accounts (DSA) or Avocado wallets. Instadapp Pro remains our flagship protocol and remains an evolving product suite .

Instadapp Lite: Strong and Steady

Instadapp Lite continues to be the longest running stETH strategy. This year we added Spark.Fi and Morpho v2/v3 to our ETH Vault allocation pools offering our users additional growth and diversification for the Lite Vaults. Instadapp Lite has achieved an average 75% higher returns compared to holding stETH.

Notably, with the release of Lido Redemptions we built a direct redemption mechanism allowing the vault to redeem stETH directly from Lido significantly improving the vaults overall liquidity. Find detailed information for Instadapp Lite on Dune.

Avocado: The Next-Gen Smart Wallet

Avocado, our groundbreaking smart wallet, debuted in March 2023. It's redefined user experience in Web3 with its intuitive UI/UX and account abstraction features abstracting transactions, networks and gas. Since launch, Avocado has continuously evolved, adding functionalities like cross chain sends, DEX aggregation, transaction building, and soon transaction batching.

Avocado's has grown to over 7,500 users, with a 99.9% transaction completion rate, and has grown to support 0ver 13+ networks since launch we deployed on Fuse, BNB, and Scroll Networks. Avocado is currently accessible from the web UI but bridging the gap for users means mobile apps! We are preparing to launch Avocado Mobile on iOS and Android platforms making Avocado even more accessible.

Avocado Multisig

We launched Avocado Multisig the first of its kind multi-chain multisig offering unparalleled levels of convenience through Avocado Account Abstraction features. As the multichain landscape gains momentum in 2024, Avocado Multisig aims to address the challenges faced by users and DAOs in managing and securing funds across multiple networks.

Distinguishing itself from Gnosis Safe, Avocado Multisig prioritizes usability for all users while retaining Avocado's account abstraction features. One Unifed Gas tank for all signers and maintaining the same address across all networks as well as Instant Onboarding makes Avocado Multisig an ideal choice for multichain protocols and users.

Avocado Protect

We launched Avocado Protect a non-custodial 2Fa service for Avocado Personal accounts. Enabling users extra security by adding two factor; Avocado Protect 2Fa is network dependent enabling users the maximum flexibility when setting up their security. Utilize Avocado Protect on one network or use it on all networks. Avocado Protect also enables users to assign a backup address as well.

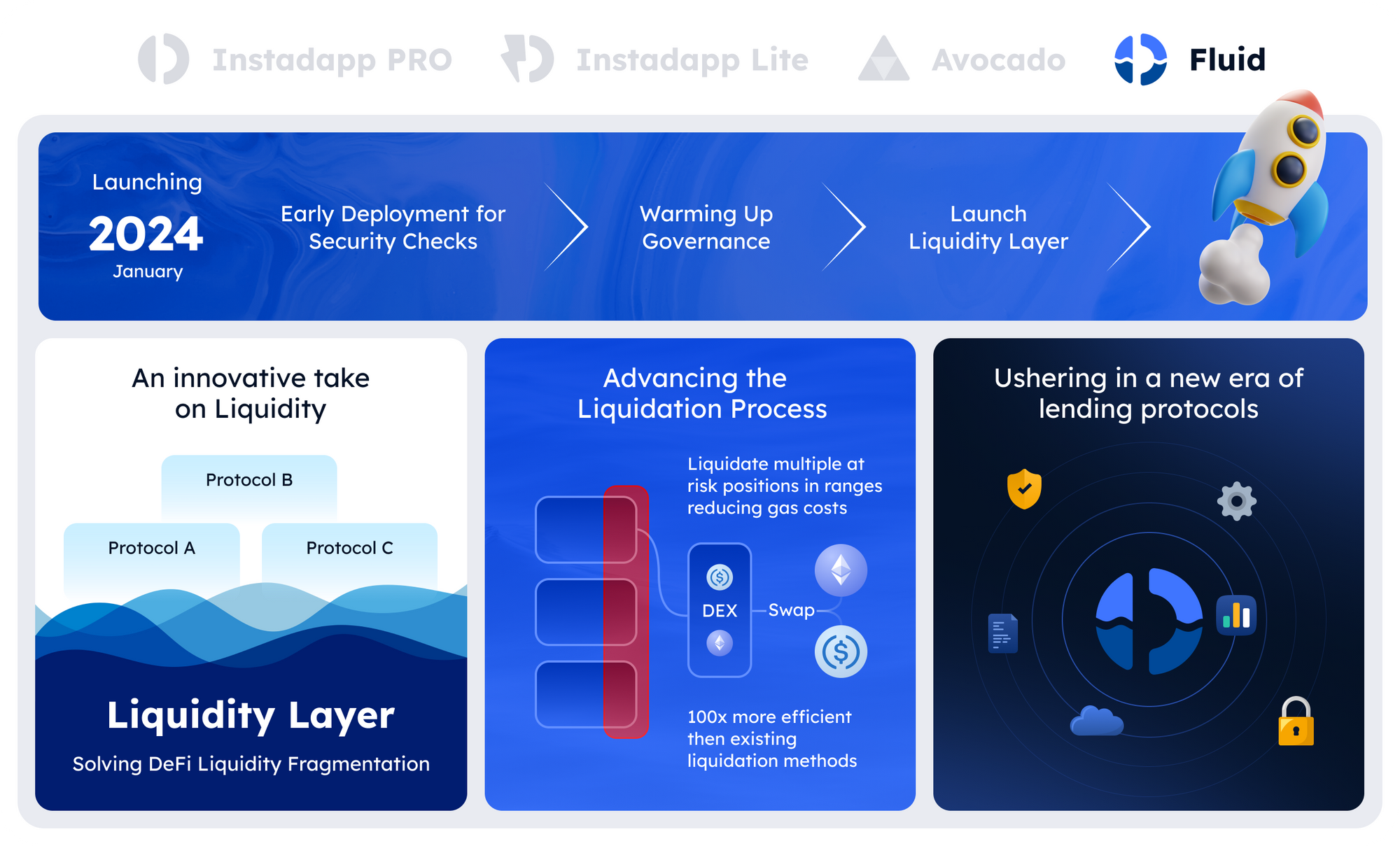

Fluid: The Future of Lending Protocols

We are excited to launch the next era of lending protocols, with the launch of Fluid in January. Fluid represents a major leap forward in lending protocols. Fluid aims to address several existing problems and inefficiencies in the lending market while developing new solutions that not only address these problems, but build a larger foundation for the future.

The Fluid Liquidity Layer enhances capital efficiency and addresses liquidity fragmentation effectively. Notably, Fluid's liquidation system operates within defined 'ranges,' reducing gas costs and speeding up debt removal. Fluid also incorporates automated limits, introducing an added layer of security for lending protocols through dynamic limits.

Fluid comprises a suite of protocols built on top of its liquidity layer, including an 'Earn' product, lending vaults, and a DEX protocol. Fluid is set to bring innovation at all levels, including smart debt and smart collateral to enhance users' capital efficiency. Governance of Fluid will be in the hands of INST token holders. For a comprehensive overview of our upcoming protocol, please refer to our blog post introducing Fluid.

Conclusion

2023 has been the biggest development year for Instadapp. With the launch of Avocado and the upcoming launch of Fluid, we've broadened our product suite while maintaining and improving existing protocols: Instadapp Pro and Instadapp Lite. We are focused on a multi-chain future and we believe our latest entries Avocado and Fluid will be pioneering in both simplifying complexities in blockchain interactions as well as advancing user UI and features. We are excited to continue to push the boundaries of DeFi and providing innovation to continue to grow this space.

Thank you for your continued support as we embark on this exciting journey into 2024 and beyond.