Introducing Fluid!

A protocol 1.5 years in the making. Fluid is the culmination of experience gained from building on top of Aave, Compound, Uniswap, Maker, and Curve. It takes the best features they offer to transform the lending and borrowing space.

Instadapp has played a leading role in the DeFi landscape right from the start in 2018. Back then, the term ‘Defi’ didn’t exist and we often referred to it as 'Open Finance.' Instadapp has for a long time been solely a middleware protocol, simplifying underlying protocols and introducing sophisticated flashloan strategies to augment protocol functionalities. We embarked on this path with MakerDAO and over time have expanded into multi-chain infrastructure with a TVL of over $2b.

Over the years, Instadapp has been deeply involved in innovating the largest lending protocols in DeFi such as MakerDAO, AAVE and Compound. Through our developments on flashloans and on Smart Accounts we were able to provide many unique features. However, as a middleware solution we could only innovate incrementally on top of these protocols, many deeper level innovations were not possible.

Fluid is the culmination of our work and experience in developing on top of lending protocols and building unique and novel functionalities over the years. Fluid has taken inspiration from many major protocols including: Uniswap v3, Aave, Compound, MakerDAO & Curve. We’ve built a protocol that combines many familiar elements related to efficiency, security and usability. This composition creates a new fundamental layer for DeFi, upon which many protocols can be built.

Fluid has been in development for more than 1.5 years, while going through many iterations over this time, we are now super stoked to introduce it to you. Fluid is the

- Most advanced

- Most secure

- Most flexible

- Most efficient

protocol in the lending space. All while maintaining the simplest user experience.

Before diving deep into the technical complexity of the protocol. Let's see how simple it will be for users.

Here are a few concepts inspired from other DeFi protocols:

- Uniswap v3 - slot based liquidity to optimize liquidation exponentially (by more than 100x)

- MakerDAO - vault mechanism to provide better asset security, reducing complexities & gas overhead and automated ceilings

- Compound & Aave - pool based liquidity with calculated risks and rates curve through utilization

- Curve/Uniswap - designing a concept of smart debt & smart collateral. Allowing users to use their collateral & debt as DEX liquidity

Some of the features Fluid enables:

- Highest LTV (Loan to value). Borrow upto 95% against ETH.

- Better rates for lenders and borrowers.

- Highest security standards by isolating risk, automated limits & protocols class.

- Earning on collateral & debt with smart collateral & smart debt.

- Lowest liquidation penalties (as low as 0.1%).

- Lowest liquidation gas (3-4 times less than most protocols).

- Capital optimization with no segregation.

Introduction to Fluid

Liquidity Layer

At the base of Fluid lies the Liquidity Layer, which serves as the foundation upon which other protocols can be built. This layer serves as a central hub where liquidity from all protocols is consolidated. It facilitates automated limits for protocols, manages utilization rates, and can deploy various rate models. The Liquidity Layer allows protocols to deposit, withdraw, borrow, and payback. End-users interact with the protocols, which in turn interact with the Liquidity layer.

Better capital efficiency

The Liquidity Layer solves a very real and current problem in the DeFi ecosystem: liquidity fragmentation.

There’s a steady stream of new protocol versions that keep emerging. Often the newer protocols, even if they bring better features, take a lot of time to accrue enough liquidity compared to older versions, especially in the absence of liquidity incentives (many months or even years). This is because every new protocol starts at zero and requires mobilization of lenders & borrowers in a balanced way, so the rates stay stable compared to the older version.

The Liquidity Layer solves this due to its flexible and open nature. When a user transitions from one protocol built on top of the Liquidity Layer to another, the liquidity on the Liquidity Layer remains unchanged, and there are no changes in rates incurred. This functionality means Fluid users will be able to instantly start utilizing new features, and new protocols without fragmenting liquidity. For example, if a newer version of a protocol allows higher LTV for borrowers, borrowers can start moving to the upgraded version while Lenders start getting better rates without any capital movement.

In the attached link it compares the old & new versions of protocols and the time it took for liquidity to migrate.

Automated Ceiling

The biggest feature of any financial protocol is its security, ensuring robustness in all circumstances and minimizing potential losses in worst-case scenarios. One simple way to do this can be found in traditional finance with daily spending limits, and other methods of monitoring the movement of large funds.

We saw DeFi protocols adopt something similar with debt ceilings and other limitations placed on the protocol. For example, MakerDAO uses a debt ceiling to mitigate their risk exposure to various assets. We observed a similar approach extended with Aave v3 isolation mode, as well as with Compound v3 and Aave v3, which imposed restrictions on the supply amount limiting the risk of supplied assets. One challenge in implementing limits is that these measures often require active management.

Fluid's Liquidity Layer introduces Automated Limits, which dynamically adjust the debt/collateral ceiling every block when funds are nearing limits. This feature allows organic borrowings to go through, while restricting any sudden whale moments. This means even if there were code vulnerabilities or economic manipulation on a protocol of Fluid, the Liquidity Layer will restrict abnormally large and sudden borrowings & withdrawals, limiting losses and buying time for the community multisig to step in and pause that particular protocol to allow governance to take appropriate action.

Liquidity Layer is a simple contract with no advanced algorithm or logic. It simply holds all the liquidity from all the protocols and makes sure that assets are highly secured. The Protocols built on top of Fluid are where the advanced algorithms are being implemented. This ensures that any vulnerabilities within these protocols will result in minimal losses for affected users.

As protocols and assets become established on Fluid, the borrowing and supply limits expand, while newer protocols can be kept on very tight limits. This allows the secure addition of new protocols without introducing additional risk to the overall Liquidity layer.

Automated ceiling are set according to the below params:

- Base ceiling

- Max ceiling

- Rate

- Limits in %

Now that we have covered the base layer of Fluid. Let’s explore some of the innovative initial protocols being built on top as well as the value they provide to the overall ecosystem.

Lending Protocol

The simplest protocol for Fluid is a lending market. A lending market allows users the simplest and most basic use case of Finance. Lend & Earn. Generally, there are 2x-5x more Lenders than there are borrowers (Lenders vs Borrowers Dune). The Lending protocol removes all the complexities related to borrowing and provides a super simple UX.

Most advancements on lending protocols have occurred on the borrowing side. Oftentimes these advancements are for borrowers only, but require lenders to shift their assets to the new protocol. This creates a lot of inefficiencies for users and in particular lenders. The Lending protocol solves this by providing users with a long term safe yield while also benefiting from any new advancements on the borrowing side without having to move any assets. The Lending protocol also allows other developers to build on top with the confidence that they can rely on it long term (eg: Balancer building aave-balancer pool or Maker supplying DAI in Compound or Aave).

The Lending protocol allows the simplest rewarding methods and follows the ERC4626 standard and is highly gas optimized, allowing simple & cheap integrations for devs.

Vault Protocol

The Vault protocol is the most advanced protocol of Fluid and is targeted towards borrowers. It offers a range of benefits over current borrowing protocols, including enhanced capital efficiency, higher LTV, better rates, lowest liquidation penalty, smart debt & smart collateral all while having the most simple UX for end users.

Similar to how Uniswap v3 innovated the Limit orders, Vault Protocol is bringing innovation to Liquidation.

While the user experience might resemble MakerDAO vaults, unlike MakerDAO, user’s on the Vault protocol earn interest on their collateral similar to any other borrow & lending protocol. You can think of this as a hybrid between AAVE markets and MakerDAO vaults.

Highest LTV

The way liquidations are implemented determines the LTV (Loan to value) of a protocol. This is because liquidations play a vital role in maintaining a protocol’s safety by eliminating bad debts on time. A protocol's safety can either be enhanced by reducing the LTV or by improving the liquidation engine. However, reducing the LTV is less desirable as it means end-users have reduced borrowing capacity, giving competitors providing higher LTV an edge. On the other hand, optimizing liquidations could lead to a much safer protocol with a higher LTV, thus improving the overall experience & utility for end-users.

The Vault protocol boasts the most significant advancements ever made in liquidation mechanism design, which has the potential to allow users to borrow up to 95% of the value of their ETH.

Liquidation mechanism

The liquidation mechanism of the Vault protocol is loosely inspired from the Uniswap v3 design and represents a 100x improvement over existing borrowing and lending protocols. It achieves that by allocating the liquidity such that all users in the range get liquidated simultaneously instead of one-by-one leading to a significant decrease in gas cost.

On Uniswap v3, when a swap happens, the swap fills all the active range orders at once without the trader having to know each range order getting filled.

Similarly the Vault protocol allows liquidation of all bad positions at once without the trader/liquidator having to know each bad position separately. (Yes we wrote trader there, hold that for one second)

The gas cost of liquidation is around ~150k. In comparison a Uniswap v3 swap is ~120k and liquidations in DeFi protocols range from 300k to 1M for a single position(Liquidation gas cost comparison Dune).

Traders are Liquidators

In general, liquidations in the Vault protocol work like a swap but with better rates. For DEX aggregators, the integration is as simple as adding any other AMM, allowing traders to get better prices. This means any trader of any size can liquidate any amount of debt. There’s no requirement to liquidate the entire bad debt at once. This allows even the smallest trade to liquidate bad debt on time and traders get the best price.

Liquidate only what’s required

On the Vault protocol, liquidations only happen until the liquidation threshold is met, nothing extra. This means for most liquidations the amount of debt liquidated is closer to 5% whereas on other protocols it can be up to 50% or 100% debt (full liquidation of position). On the Vault protocol, when users are liquidated, they will lose 5-10x less than on other borrowing protocols.

There are higher-level ecosystem benefits as well due to liquidating only what’s required. If all the users in the ecosystem are using the Vault protocol to manage their debt positions, then the negative externalities produced by forced selling and cascading effects can be reduced by 5-10x. Making the overall ecosystem more efficient and stable.

Lowest Liquidation penalty

Liquidation on the Vault protocol can be as low as 0.1% while in comparison to other protocols which are generally between 5-10%. Saving users up to 50-100x on liquidation penalties.

Oracles

Oracles are a critical component of any lending and borrowing protocol. They enable the timely liquidation of bad liquidity from the protocol and allow for efficient liquidity by providing up-to-date pricing information. By leveraging oracles, protocols can improve their overall security and potentially increase their loan-to-value (LTV) ratios.

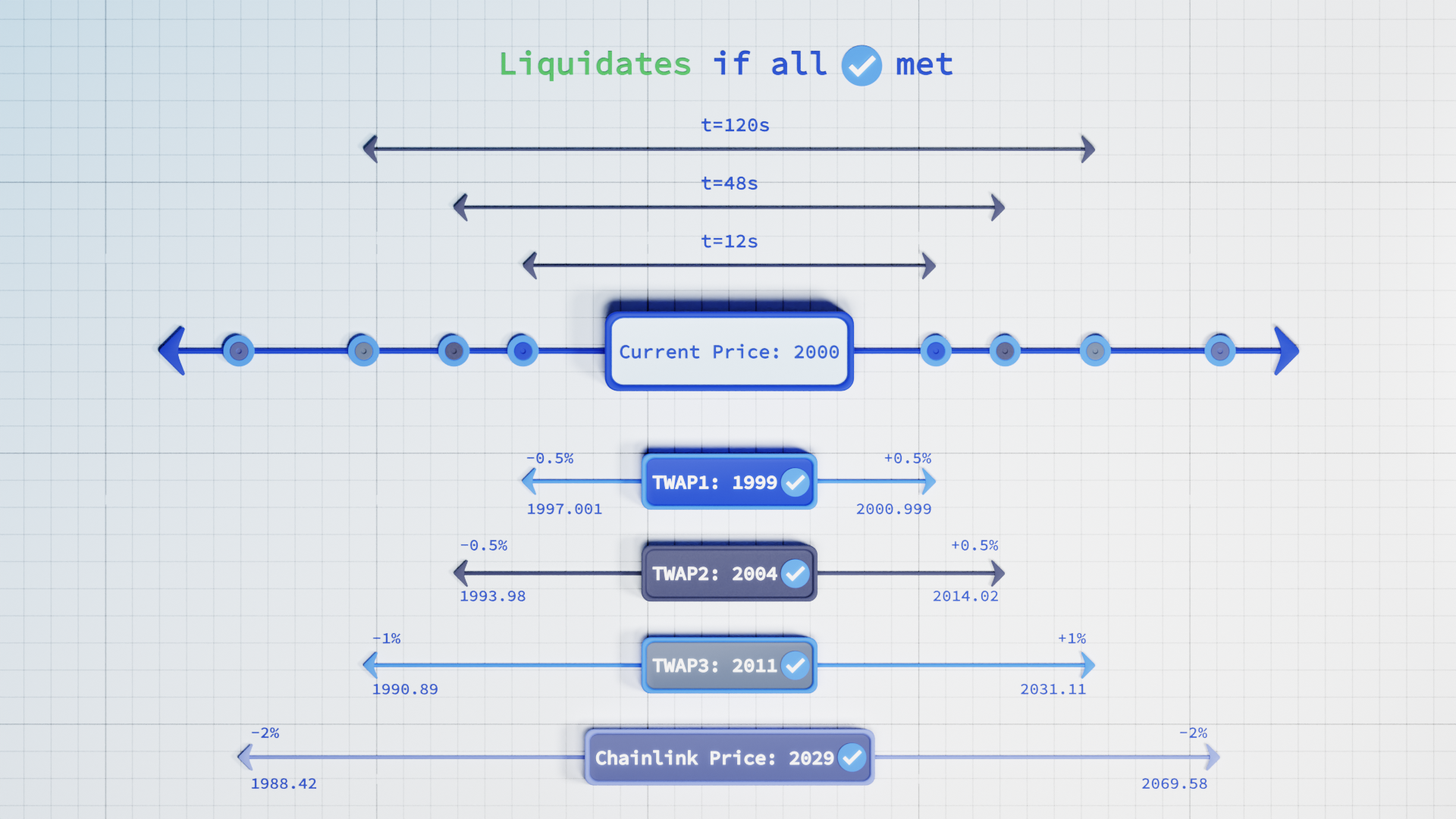

The Vault protocol of Fluid utilizes an oracle system that combines Uniswap and Chainlink to ensure the most reliable and accurate pricing data (Oracle price comparison Dune). The protocol checks three different time-weighted average price (TWAP) checkpoints and the Chainlink price, comparing them with the current Uniswap price to verify that it falls within a specific range and has not been manipulated in any way. This ensures that the protocol can use the current DeFi price for liquidation purposes while removing the possibility of manipulation (or making it extremely costly).

For geeks wanting to involve in more technical explanation on how the overall vault protocol allocates liquidity & how the liquidation algorithm works. Follow our Whitepaper.

Note : Vault protocol v2: With the recent announcement of Uniswap v4, we have also proposed the most advanced ‘Oracleless’ lending protocol on top of v4. For more details, check out here.

DEX protocol

The DEX protocol is a novel protocol which introduces smart debt and smart collateral. This will empower users to utilize their debt and collateral as liquidity for trading purposes. The v1 of DEX protocol will be similar to a combination of Uniswap v2 & Uniswap v3 - Single auto rebalancing range order, UX like Uniswap v2 & concentration like Uniswap v3. V2 can be based on Uniswap v4 (still in ideation phase).

Smart collateral pools is like any AMM pool, where users can earn from trading fee while simultaneously lending their collateral & borrowing against it. On the other hand, the smart debt pools can be considered as an inverse of any AMM pool, allowing borrowers to use their debt as liquidity and getting discount on debt through trading fees.

By leveraging these innovative features, users will be able to access the best rates in the ecosystem, earning more on their collateral and receiving discounts on their debt. The DEX protocol is the only protocol which allows your debt to be a productive asset.

Smart Debt

Smart debt is the only financial primitive (that we know of) which allows you to turn your debt into a productive asset by using debt as a liquidity and allowing traders to trade on top of it. Smart debt can be considered as the inverse of any AMM pools. Rather than having token as liquidity, the debt is being used as liquidity and with every trade rather than increasing the token liquidity from swap fees, smart debt reduces debt from swap fees.

Liquidity

How does liquidity get built up in the smart debt pool?

Users borrow from a smart debt pool via the enabled vaults. For example, a vault as ETH collateral & smart debt of USDC/USDT. Users deposit their collateral and borrow against it. The borrowing happens through the smart debt pool and a share of the overall pool is allocated to that particular user.

Earn on your liability

While the borrow rate generally remains stable ranging from 3-5% (depending on how the rate curve is being managed), the trading APR varies from day to day depending on the trading activity. This will allow users to get the best borrow rates in the industry, so much so that in some scenarios they might even get paid to borrow. Making Fluid the perfect place to manage your position.

What if one of the token in smart debt pool goes to zero? Will I lose anything in that case? Short answer is no. Check out this link for more details.

Smart Collateral

Smart collateral pools is like any other AMM pool, where users can earn from trading fee while simultaneously lending their collateral & borrowing against it.

As explained above v1 of smart collateral will be similar to a combination of Uniswap v2 & Uniswap v3 - Single auto rebalancing range order. Hence has the similar way of building up liquidity, earnings through trading fees & risks.

Governance

INST will be governance token for Fluid. Similar to any other borrowing & lending protocol, INST holders will have a responsibility to decide each & every component of it.

On launch, the major responsibilities are as follows:

- Setting rate curves, fees & configurations for tokens in Liquidity layer.

- Protocols configurations & allowance to interact with Liquidity layer.

- Establishing automated limits and class for protocols.

- Setting up Vault's Configuration.

- Determining rewards on Lending protocol and Vault protocol.

Timeline

- November end. Wrapping up formal audits. Making codebase public & start of open audits.

- Mid December. Governance body or team will deposit $500,000 into Fluid. Anyone who successfully hacks it can claim the entire amount.

- Mid January. Launching the protocol with Lending & Vault Protocol and liqiudity layer as base.

- DEX protocol launch will be followed after couple of months.

Conclusion

Fluid represents the culmination of our extensive experience in developing on top DeFi protocols. Fluid is an innovative base layer from where many DeFi protocols can be built on top in new and more capital efficient ways. Fluid solves long standing issue of fragmented liquidity and provides an innovative base layer for new innovative DeFi protocols to be build upon, allowing better utilities to users such as high LTV, better rates, productive debt and anything new to come in future. Our goal is to make Fluid as the financial layer of future.