FLUID Reserve: Buybacks & Growth Strategy

Over the past 18 months, Fluid has rapidly established itself as one of DeFi’s top-tier protocols and fastest-growing DEX on Ethereum. With over $6B in market size, $15M+ in annualized revenue, and leading positions across lending and stablecoin swaps, Fluid has shown that its capital-efficient architecture delivers real results at scale.

Now, the protocol is entering a new phase: the creation of an onchain reserve of FLUID tokens, guided by a transparent buyback and growth strategy designed to strengthen the ecosystem for the long run, that started this October.

Why This Matters

Fluid is already:

- The most advanced protocol, pioneering a connected liquidity layer with innovations such as Smart Debt and Smart Collateral.

- Top 3 lending market, with $2.5B in active loans across all chains

- $117B+ in cumulative trading volume (fastest DEX ever to $100B on Ethereum)

- Earning $15M+ annualized revenue

- #2 DEX by volume and fees on Ethereum and #3 DEX across all chains

- #1 in stablecoin swaps USDC/USDT - GHO/USDC - USDE/USDT

- #1 fastest-growing lending DAO

- $6B+ market size, up 574% YoY (from $816M in 2024)

- Jupiter Lend (Solana), built in collaboration with Jupiter Exchange,: $700M+ TVL and $1.3B market size in just weeks, making it the second-largest lending protocol on Solana

- Fluid Lite ETH Vault: $250M TVL, earning 7.1% APY for retail users

- FLUID first DeFi token investment by a Nasdaq company (StableX)

These results are impressive on their own. But they’re also just the starting point.

Over the next six months, Fluid is targeting:

- $10B market size

- $30M annualized revenue

- Launches of new products like USD Lite Vault and DEX V2

- Expansion to more partners, chains, tokens and regions.

- And for the future: Permissionless vaults/DEXes, fixed rates, perps & more

Reaching these milestones means greater liquidity depth, a more diversified revenue base, and stronger positioning for institutional adoption.

The Role of Buybacks to build The Fluid Reserve

The FLUID token is at the core of protocol governance, community alignment, and long-term value creation. Introducing The Fluid Reserve and a structured buyback program is meant to:

- Establish a strategic reserve that can support governance, stability and growth.

- Align incentives between protocol growth, token holders and Fluid growth.

- Build resilience in varying market conditions.

Following extensive discussion on the forum proposal, including feedback from contributors, community members, and a market study benchmarking healthy FDV-to-revenue ratios across leading DeFi protocols, the DAO has proceeded with the buyback process.

Dedicated Fluid Reserve Buyback & Tracking System

The team is developing a dedicated buyback and tracking system to determine the optimal share of protocol revenue allocated to buybacks. This automated infrastructure requires additional development time, as recent priorities have focused on:

- Launching Fluid on Solana

- Preparing for the Plasma integration

- Developing and testing DEX V2

In the interim, the DAO will follow a transitional approach, directing 100% of Ethereum mainnet revenue toward buybacks during the first month.

- View the first buyback transaction here.

- This is a community owned dashboard until the official tracking system and dashboard goes live.

- Wait for more updates shared via the Governance Forum and X.

Launch Timeline

- First Week of October — Buybacks officially began, as outlined in the original proposal.

- First month (October, 2025) — 100% of Ethereum mainnet revenue will be directed toward buybacks.

- Execution — To promote transparency and market stability, buybacks will be carried out through multiple smaller transactions.

- Infrastructure — A dedicated buyback system and tracking dashboard will be developed and shared with the community.

- Next phase — Once the infrastructure of the dedicated buyback system and tracking dashboard is complete, governance will review and refine the long-term model to ensure it remains transparent, sustainable, and aligned with Fluid’s growth strategy.

- Additional revenue streams will be included.

- The model will adjust dynamically to market conditions.

- The DAO will evaluate results and iterate on the strategy.

Revenue Sources

Currently, Ethereum mainnet generates over 80% of Fluid’s total revenue, making it the most significant driver for the buyback program. Based on current market prices, this translates to approximately 1.7M of buying pressure in October.

Future iterations of the program will incorporate Jupiter Lend and L2 revenue streams as part of a more holistic framework.

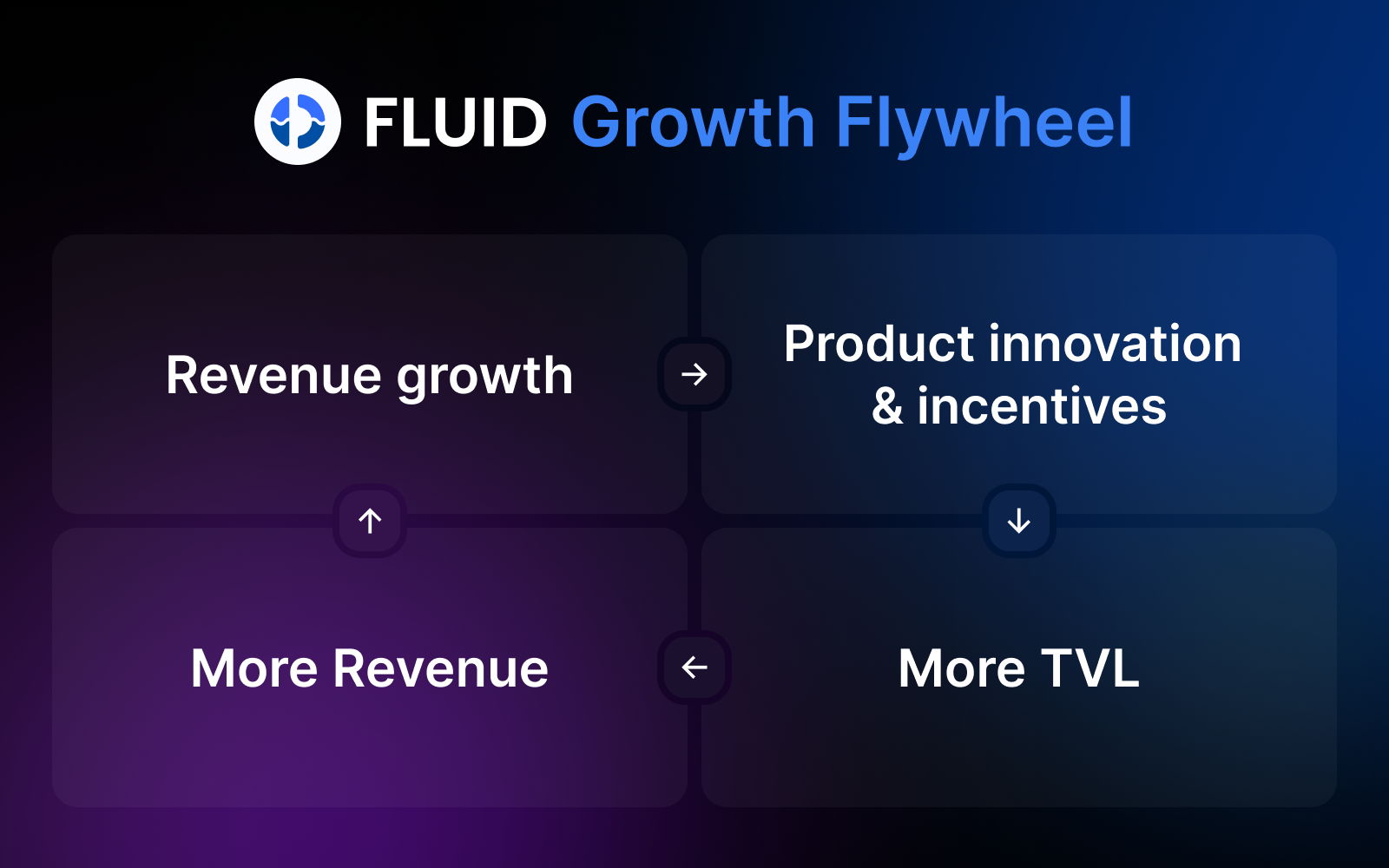

Growth Flywheel

Fluid’s design has always centered around a self-reinforcing growth loop:

Revenue growth → Product innovation & incentives → More TVL → More revenue

The Fluid Reserve is one piece of this flywheel, but equally important is maintaining a healthy DAO treasury. A robust reserve allows Fluid to:

- Fund new product development and integrations.

- Attract third-party security and growth partners.

- Continue innovating even during bear markets.

This balance of reinvestment and strategic buybacks is key to building a sustainable, resilient DeFi ecosystem.

Looking Ahead

October marks the beginning of The Fluid Reserve. Buybacks will be implemented onchain and evaluated over a six-month period. The results will help guide long-term decisions as Fluid scales toward its next stage of growth.

But this isn’t just about numbers. It’s about keeping building the Most Advanced DeFi Protocol and Liquidity Layer, an ecosystem where liquidity is deeper, capital efficiency is maximized, and governance is community-driven.

Stay Fluid.

Disclaimer

This article is for informational purposes only. It contains forward-looking statements, including expectations around product launches, revenue, and growth targets.

These statements are based on current assumptions and are subject to risks and uncertainties. Actual results may differ materially.

Please do your own research and refer to the official governance channels for updates.