Introducing Fluid DEX v2

We’ve taken inspiration from everything in DeFi to build something beyond just a better DEX — we're creating the most advanced decentralized exchange the crypto space has ever seen. Fluid DEX v2 is not just an upgrade; it’s a complete reinvention of what a DEX can be.

DEX v2 is designed to absorb the best of every major DEX and then go further, enabling features and strategies that were never before possible. With this upgrade, LPs will unlock an unprecedented level of flexibility, and Fluid aims to become the biggest and most capital-efficient AMM in crypto.

From DEX v1 to v2: A Quick Recap

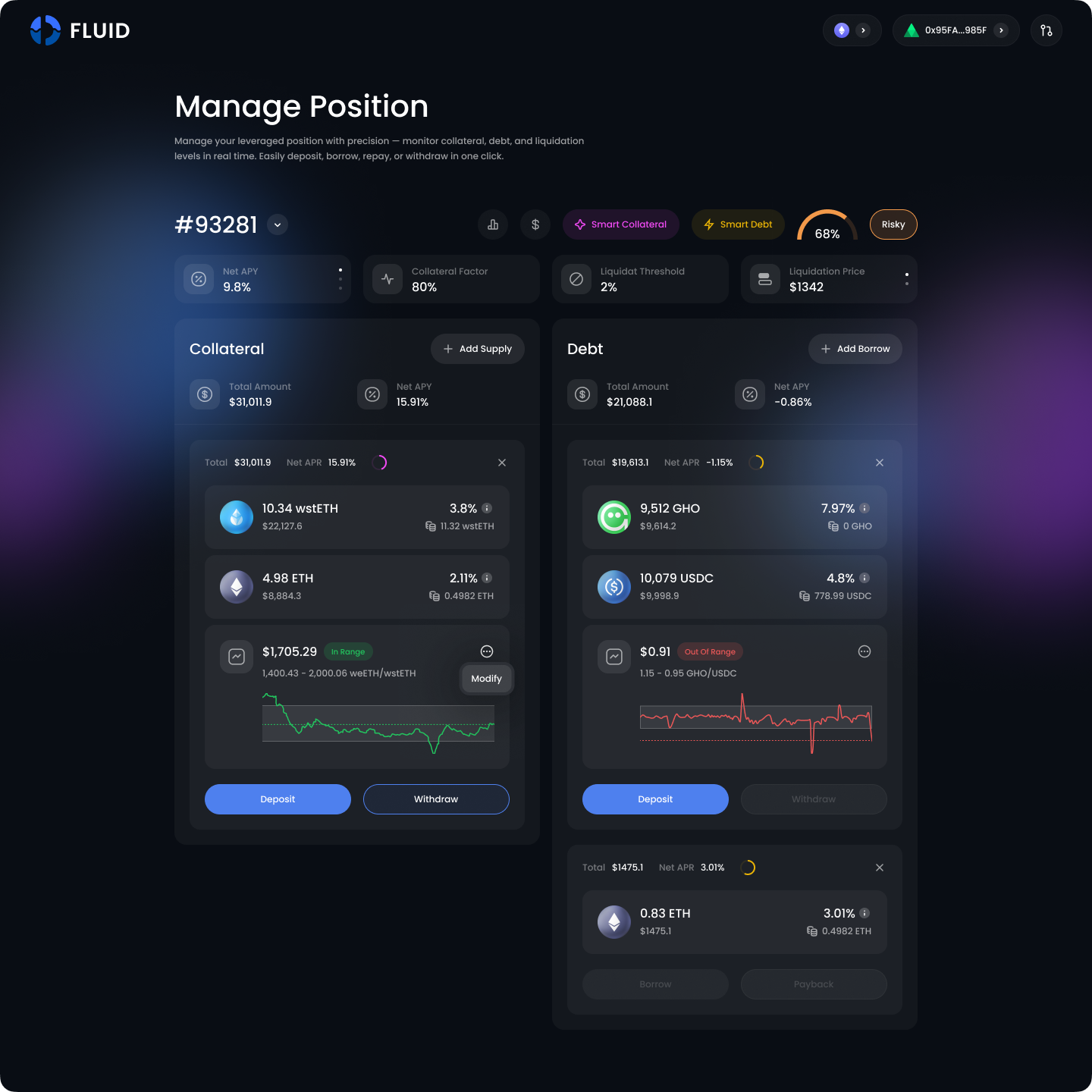

Fluid DEX v1 launched on October 29, 2024, introducing powerful financial primitives: Smart Collateral and Smart Debt. Within just three months, it became the fastest-growing DEX and the second biggest DEX on Ethereum.

Before we even shipped v1, the architecture and roadmap for DEX v2 were already being laid down. This post dives deep into what makes DEX v2 the foundation for any type of AMM.

Architecture Overview

At its core, Fluid DEX v2 runs on a singleton contract built atop the Fluid Liquidity Layer. This unified structure enables infinite composability while massively improving capital efficiency and gas usage as well as allowing cross-collateralization.

Governance can deploy infinite DEX types, each with its own logic and math, supporting every known AMM model and allowing for the creation of new ones.

On launch, DEX v2 will support 4 major DEX types:

- Type 1: DEX v1 Smart Collateral

- Type 2: DEX v1 Smart Debt

DEX v1 codebase will be ported to DEX v2 with minimal updates to allow better gas efficiency and some new features.

- Type 3: Smart Collateral Range Orders

Like Uniswap v3 range orders, but enhanced — the liquidity earns lending APR by default and can be used as collateral.

- Type 4: Smart Debt Range Orders

Create range orders on the debt side by borrowing assets - a completely new primitive.

More DEX types are in the works - including one focused on building the most advanced perpetuals system ever seen on-chain.

Focus on Openness

DEX v2 is built with modularity and permissionless expansion in mind. It will support:

- Fully Permissionless Smart Lending Pools

Anyone can deploy Smart Collateral-based DEXes with no debt features. - Conditionally Permissionless Smart Collateral

Anyone can deploy Smart Collateral pools as allowed by governance (eg: users can deploy their own ETH-USDC pool and use that pool’s range order as collateral by default) - Conditionally Permissionless Smart Debt

Anyone can deploy Smart Debt pools as allowed by governance (eg: users can deploy their own USDC-USDT pool and use that pool debt range order with whitelisted collaterals) - Conditionally Permissionless Smart Collateral and Smart Debt

Anyone can deploy multiple Smart Collateral range orders and Smart Debt range orders as allowed by governance (eg: users can deploy wBTC-USDT and sUSDe-USDC as Smart Collateral and borrow ETH-USDC and USDC-USDT as Smart Debt)

In the future, Fluid will allow for fully permissionless Smart Collateral and Smart Debt, allowing users and protocols to create any kind of collateral and debt positions.

DEX features

DEX v2 goes far beyond standard AMM capabilities:

- Smart Collateral Range Orders

By default, LP positions earn lending APR. - Smart Debt Range Orders

A completely new primitive, allowing LPs to create strategies that were not possible before. - On-Chain Dynamic Fees

DEX v2 inbuilt Dynamic Fee or Custom Algorithm via Hooks. - Hooks (Inspired by Uniswap v4)

Custom logic and automation for DEX interactions. - Flash Accounting (Inspired by Uniswap v4)

Boosts gas efficiency for CEX-DEX arbitrage and complex flows. - On-Chain Limit Orders

Limit orders earn lending APR while waiting to be filled. - DEX v1 supports

Everything that DEX v1 does, but in a more gas-efficient way.

Strategy Examples

DEX v2 allows LPs to combine Smart Collateral and Smart Debt to build advanced positions with built-in leverage, yield, and flexibility.

Here are a few examples:

Multiple Smart Collateral and Smart Debt range orders:

Borrowing against the Smart Collateral:

Smart LP strategy: Convert $1 into $10:

Stable ETH Strategy: Max Leverage Loop (convert $1 into $39)

Combination of Range Orders and Normal Collaterals

With DEX v2 primitives, LPs can invent entirely new yield and trading strategies — or automate them using hooks and composable contracts.

Conclusion

Fluid DEX v2 isn't just a product upgrade — it's a leap forward in AMM design.

With unmatched flexibility, a robust architecture for growth, and the introduction of financial logic that simply wasn’t possible before, DEX v2 positions Fluid as the frontrunner to become the most dominant AMM in DeFi.

Want to explore more? Join our Discord and follow us on Twitter — we’ll be sharing technical docs, live demos, and upcoming DEX types over the next few weeks.

Official links

Website https://fluid.io/

Discord https://discord.com/invite/C76CeZc

Governance https://fluid.io/gov