Introducing Lite v2

We launched Instadapp Lite less than a year ago, and at that time, Lite vaults reached ~$200M across four vaults. Lite was put through the test when stETH lost its peg in the aftermath of the Luna meltdown. Lite came out a lot stronger with better security practices.

As we approach the Shanghai fork, we're excited to announce Lite v2, with multi-protocol support, increased APRs, improved withdrawal capacities, and easy upgradability for new functionalities to be added in the future. Lite v2 will be deployed and made live in the coming week.

Lite v2 makes things even simpler.

At first, Lite v2 will launch with an ETH-only vault, meaning it will accept only ETH deposits and focus on a multitude of stETH-related strategies to return yield to users. It leverages the new ERc-4626 standard, opening the door for the composability of iETH tokens across DeFi protocols.

High APR with Multi-protocol-strategy Support:

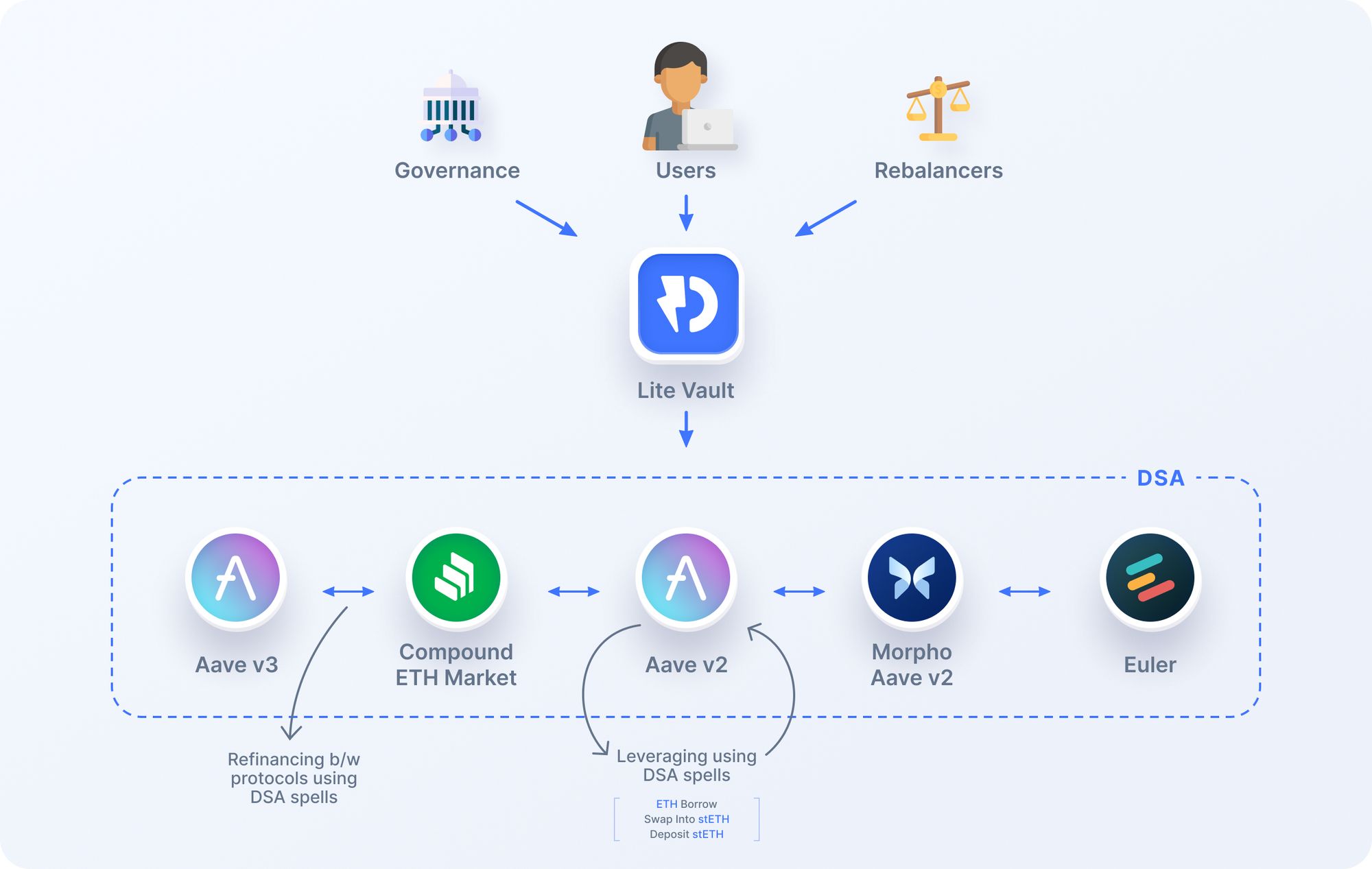

Lite v1 vaults were single protocol oriented, using Aave v2. Lite v2 is multi-protocol oriented. The new vaults will support multiple protocols and multiple strategies on launch.

Essentially, users' assets will be leveraged on the protocol that provides the highest APR at the time. On launch, the vault will support these protocols:

- Aave v2

- Compound’s ETH market

- Morpho Aave v2

- Aave v3

- Euler

Improved Withdrawals

One of our major goals in improving the vaults is improving the withdrawal capacities. Firstly up to 50% withdrawal capacity will be available, allowing 50% of the users to leave the vault without incurring any loss. Multi-protocol support allows the vaults to maintain competitive rates while still allowing high withdrawal capacities.

For example, if Morpho Aave v2 provides the best APR the assets will be leveraged here, but as users start to withdraw the assets, the assets will start to move towards Aave v3, which might provide less APR but has a higher liquidation threshold. This allows the vault to have the same risk exposure while improving and facilitating withdrawals.

As the vaults are upgradeable, the vault can adapt to newer strategies in the future. For example, the ETH vault can provide liquidity to trade between stETH <> ETH, creating better yields for users on stETH -> ETH swaps, and self-deleveraging on ETH -> stETH swaps at a negligible loss.

Fees

The ETH vault will charge 20% on profits. All fees earned by Instadapp Lite go to the DAO. The vault will be deployed and primary parameters will be set by the team. After the initial deployment, the ownership will be transferred to the DAO immediately which will then be responsible for future updates.

Rebalancers

For day-to-day changes, the vault has special permission for these accounts called Rebalancers. Rebalancers cannot withdraw funds from the vault. Rebalancer can deposit assets from the vault to protocols, withdraw assets from protocols to the vault, move assets between protocols, and leverage. The max ratios and available protocols will be set by governance which will make sure the vault is in a safe state after any rebalancing.

The Rebalancer can carry out the following transactions on the vault:

- Deposit - Deposit assets from the vault into a protocol whenever the vault has excess deposits.

- Withdraw - Withdraw assets supplied to a protocol back to the Vault. It can only happen as per the max ratios set at inception or governance voting. (when the vault has lower assets to withdraw)

- Leverage - Leveraging the assets to earn greater yield as per the max ratios set at inception or governance voting.

- Refinance - Move assets between protocols. The destination and target protocol both needs to stay below the max ratios set at inception or governance voting.

Team Multi-Sig

The team multi-sig has some permissions into the vault for emergency and limited use. The team multi-sig can be used to reduce ratios for a particular protocol and can ‘pause’ the vault by either pausing withdrawals or rebalancing. These functions do not change the ownership of the assets and do not prevent users from trading or transferring the underlying iToken.

The ability to reduce ratios from a particular protocol can be useful if the current protocol being supplied by the vault incurred some sudden change that makes it unfavorable, such as changes to the liquidation threshold for stETH, reduction in collateral factor, etc.

The Team Multi-Sig has no access to users' funds at any point. It can only change parameters in ways that will protect the vault from unforeseen market conditions.

⚠️ Deprecation Alert (for Lite v1 users)

As a new ETH vault comes into action, the non-ETH vaults of Lite v1 will be deleveraged, allowing users to withdraw their funds without incurring any loss. This means all Lite v1 vaults will be deprecated. There were several reasons to make the change:

- The non-ETH vaults in particular were having withdrawal issues making it difficult for these holders to withdraw.

- The non-ETH vaults used an uncorrelated asset strategy, which requires more active management and incurs more on-chain rebalancing.

For holders of iUSDC, iDAI, and iwBTC:

As this new ETH vault increases in volume, the v1 non-ETH token vaults will deleverage and have more withdrawal capacity in the withdraw pool allowing you to exit the vault without incurring any loss.

For holders of iETH:

The current ETH vault deposits an upgrade to the new vault in a 1-click migration that will be provided when the vault will launch. We recommend all ETH depositors upgrade to the new vaults. However, the ETH v1 vault will continue to remain operational.

For stablecoin suppliers, we are in the development of a novel stablecoin vault. We will introduce a USDC/USDT stablecoin vault that will offer similar improvements but will utilize Uniswap v3. We’ll share more on that soon.

iETH and Beyond

As mentioned above we'll soon introduce a stable coin vault to cater to our users' experience and improves Lite's overall utility. The goal is to continuously enhance the vault and make it more dynamic so we can run more strategies and have a competitive advantage in yields while improving withdrawal liquidity.

We look forward to integrating iTokens into a larger ecosystem with improved liquidity and rebalancing mechanisms, such that iTokens can safely be used as collateral on other applications.

Learn more about Instadapp by following us on Twitter for regular updates and launches, get to know us closely, and ask us those hard questions (or just say hi) up front on Discord. Nonetheless, if you need to contact us, feel free to email us.